The Importance of Credit History for Tenant Screening

- Tracy Shatus

- Mar 20, 2020

- 3 min read

Updated: Aug 7, 2025

One of the most important aspects to consider when choosing a new tenant is credit checks. In fact, every landlord will be more than happy to know if the prospective tenant is likely to pay their rent on time besides what they claim during negotiations.

It is true that checking for credit history and tenant screening incur some costs. However, just because of the cost factor ($15-20), a landlord should not avoid doing it.

To cover that, you can charge an application fee on all the prospective tenants.

The information included in a tenant screening

As a result of performing a credit history and tenant screening, you will be able to read some specific information about the prospective tenants. That information will inspire you about the prospective tenant so you can decide whether or not to accept him or her.

Identification information

This refers to the information such as name, address and social security number of the tenant.

Credit history

This segment will include information about the bank account for a period of 7 to 10 years. In addition to that, it exposes credit card information and loan information of the respective tenant with a FICO score. You will be able to see how long their accounts have been open, the history of the payments, their loan limits, etc. as well.

Public Records

Information related to previous evictions, tax liens, bankruptcies, and civil judgments will be included in the public records segment.

Inquiries

This segment exposes who else has requested credit reports for the prospective tenant (for the last 12 months).

Well, as you may notice, a credit report comprises a large amount of data.

Credit history for tenant screening suggests whether or not to rent your property

After reading the credit report, you can decide if the prospective tenant is suitable to be accepted. Well, if all the indicators including the credit report are positive, that’s a green light. If that is the case, you can proceed to sign the necessary paperwork and collect the deposit. Once that is over, you can simply hand over the keys to the tenant. Such an approach will allow you to rest easy because you have done your best to keep the troubles away. If the report is not the perfect one but has some positives, you may consider renting out your property under a higher deposit. The deposit can be determined by you. You must explain the reason for a higher deposit in writing.

However, if the report doesn’t give a good impression of the tenant, the best approach is not to rent to the respective applicant. You must make sure that you let them know (in writing) the exact reasons to deny their request. Also, you can allow them to have a free copy of the credit report so they know what is what.

Now that you know the importance of a credit history report, you can consider it as a deal-breaker that differentiates great tenants from the rest.

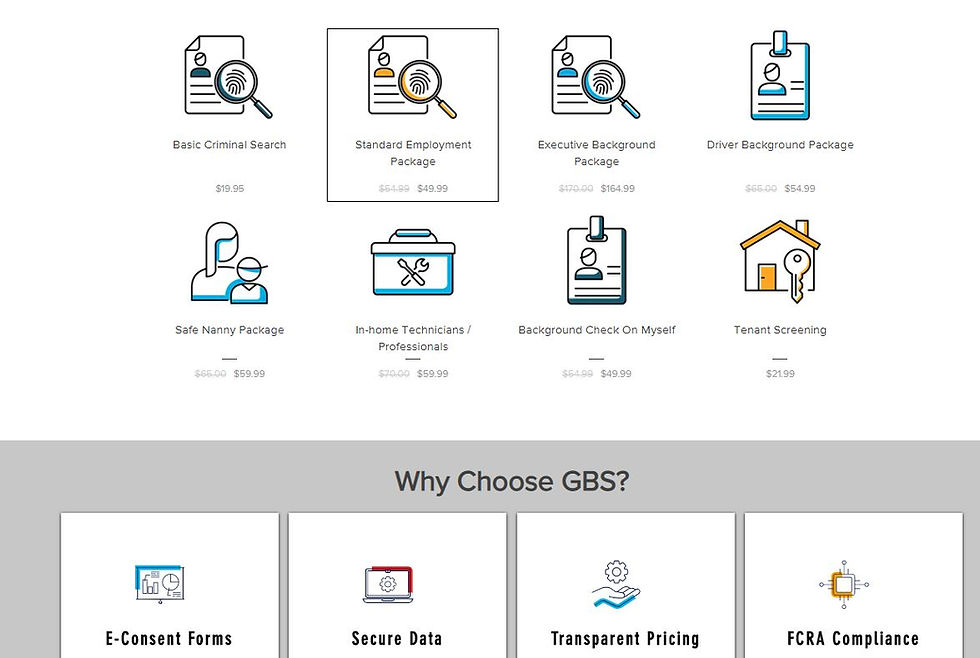

Global Background Screening LLC handles all Tenant Background Checks and provides you an easy to use platform where ordering takes 30 seconds. Estimated times for our packages are generally 1-3 business days.

For our Tennessee community, also learn about: how long does it take to evict a tenant in Tennessee on our next article.